Why We Disagree with Typical Financial Advice: Strategic Literacy for Today’s Economy

Update: The U.S. fiscal landscape is evolving rapidly. National debt has surpassed $36.1 trillion, credit ratings are under pressure (Fitch downgrade), and the U.S. Treasury is navigating costly reforms. Strategic financial literacy is no longer optional.

Today’s literacy isn’t just about budgeting. It’s about interpreting risk, spotting misinformation, and making smart moves with capital and compliance top of mind.

Welcome to the New Era

We live in a time where:

- You can invest in private equity or crowdfund in minutes.

- You can access capital from fintechs or tokenize assets with a few clicks.

- You can use AI to automate financial forecasting or detect fraud.

But complexity scales with access. And consequences hit harder, faster, and more frequently when the wrong decisions are made.

It’s Not Just Access — It’s Discernment

"The tools are here. The access is greater. But the risks? They’re faster, louder, and more complicated than ever."

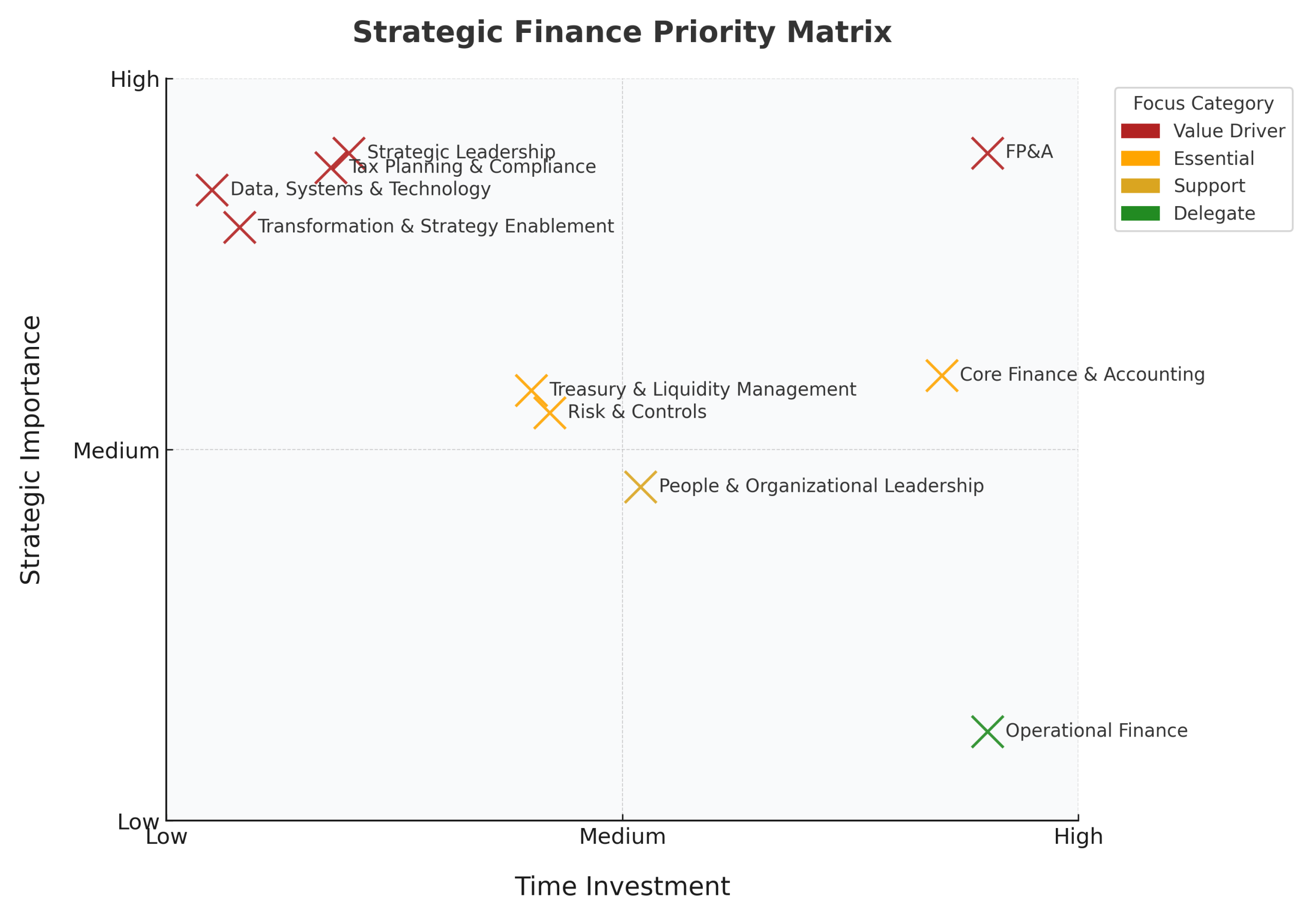

Strategic fluency means knowing what to ask, what to validate, and when to pause. It’s the ability to think across disciplines — tax, tech, compliance, and capital — all at once.

And in a world of bite-sized advice and viral financial influencers, misinformation is a real risk. Everyone has a “hot take.” Few have context.

What Modern Financial Literacy Looks Like

Here are 4 real-world skills that define it:

- Understand your capital stack: Know your debt, equity, and cost of capital — not just your runway.

- Validate tax exposure: Don’t rely blindly on AI or automation. Know your liabilities before the IRS does.

- Protect your downside: Entities, insurance, contracts — modern literacy includes structural risk management.

- Use decision frameworks: Every choice should pass a basic test: control, cost, return, and time horizon.

Financial Strategy Is Financial Literacy

At R2 Advisors, we help leaders move from basic understanding to strategic fluency. We decode complexity, simplify decision-making, and build financial structures that last. Rethink outdated advice. Learn how our Client Advisory Services empower you to make strategic, risk-aware decisions in today’s fast-moving economy.

If you’re building something real — a business, a portfolio, a life — your financial literacy must evolve with the world around it.

Let’s Talk Strategy →