Forecasts, Floods, and the Future:

What the Texas Flood Teaches Us About Business Planning

In July 2025, flash floods swept across Central Texas with devastating impact ,over 100 lives lost, including children at a summer camp, as the Guadalupe River surged nearly 26 feet in one hour. (PBS NewsHour).While data from weather forecasting systems was accurate, it failed in execution—alerts didn’t reach communities in time. This breakdown in operational response is not just a government problem,it mirrors a deeper issue in business: how many companies are overconfident in their financial forecasting but underprepared for real risk?

The story is heartbreaking and all too familiar. Some had just returned from fireworks, others were asleep. In a matter of hours, families were left stranded on rooftops, cars were swept away, and emergency responders were overwhelmed. The flood was a force of nature—but the tragedy was compounded by human assumptions: that the system would work, that things would be fine, that worst-case scenarios were too unlikely to plan for.

In business, we see this mindset far too often. Forecasting is either put on the back burner, underfunded, or delegated without strategy. As leaders and critical decision-makers, we regularly encounter organizations that view forecasts as a finance task, not a strategic necessity. They rely on last year’s budget plus 10%, or they overfit to historic trends and overlook variables that are changing faster than ever before. It’s like watching storm clouds roll in and assuming clear skies just because last summer was dry.

As CFO's, we have learned the hard way: forecasts are only as good as their inputs and assumptions, and they're only valuable when acted upon. Good forecasting is proactive risk management as well as it’s operational intelligence, market sensitivity, and strategic alignment rolled into one. It should influence hiring plans, vendor contracts, cash positions, pricing strategy, and capital allocation. And it should evolve in real time.

Picture your company as a vessel. Financial forecasting is the radar that tells you where the storms are forming—before you sail into them. Yet too many businesses are navigating on outdated charts or flying blind, reacting only when they’re already in rough waters.

At R2 Advisors, we help organizations transform static budgets into dynamic forecasting tools that serve as a strategic advantage. Strategic forecasting and scenario planning aren’t just financial tasks—they are essential components of business resilience, helping companies pivot early, reduce risk exposure, and make smarter decisions before storms—literal or financial—hit.CFO-level forecasting, scenario analysis, and financial strategy that help organizations navigate the unknown.

The Forecasting Fallacy: Good Data ≠ Good Decisions

In Texas, the National Weather Service defended their forecasts. But local infrastructure—like flood sirens or community alerts—wasn’t in place. In business, the same happens. A company may have the data, but without actionable delivery and cross-functional ownership, it fails.

Industry Examples of Forecasting Gaps

Hospitality/Real Estate Example: A boutique hotel group projected summer occupancy at 85%. But with rising flight costs and regional wildfires, cancellations surged. They hadn’t modeled a mid-case scenario and ended up overstaffed and underbooked.

Not-for-Profit Example: A regional nonprofit expanded services with grant funding, assuming renewal was guaranteed. Forecasting failed to include the risk of political change—and when funding was delayed, the organization was forced into layoffs.

Technology Company Example: A SaaS company expected 30% growth based on historical trends. When two major enterprise clients delayed onboarding, the company missed payroll targets. No scenario had accounted for slower sales cycles.

Professional Services Example: A law firm hired aggressively in Q1 expecting new client growth. But an economic slowdown led to cutbacks in legal spend. Lack of downside planning resulted in excessive overhead.

Distribution Company Example: A wholesale distributor failed to model delays in global shipping. When a strike hit port operations, their forecasted margins evaporated due to expedited shipping and penalty costs.

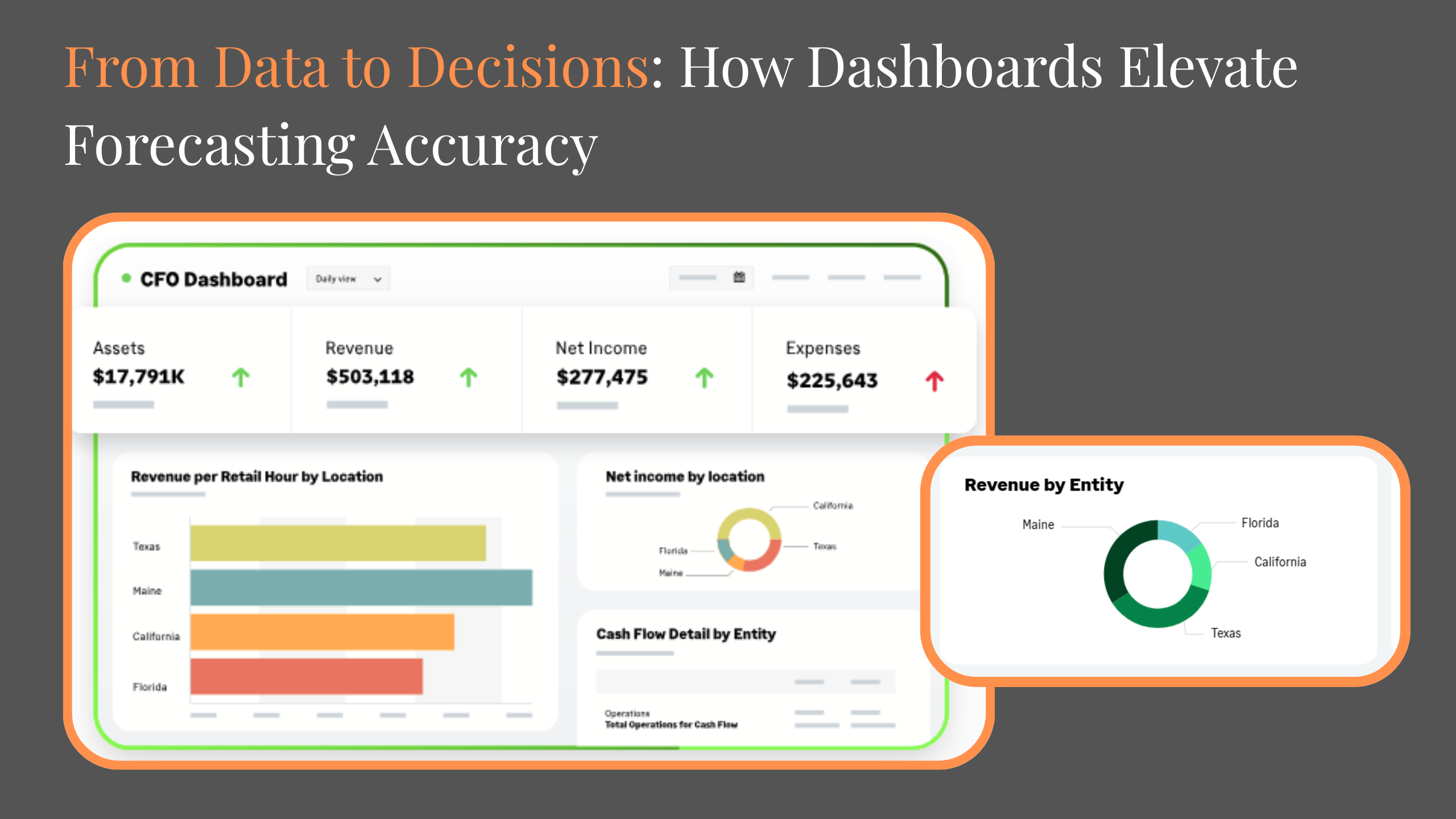

Dashboards for Strategic Forecasting & Scenario Planning

One of the most underutilized yet impactful tools in forecasting is a well-designed dashboard. Dashboards bridge the gap between finance and operations by translating raw data into real-time, actionable insights. They empower leadership to spot trends early, respond quickly, and stay aligned across teams.

- Real-time tracking of key financial metrics (revenue, expenses, cash flow)

- Scenario analysis tools with adjustable assumptions for best-, base-, and worst-case planning

- Alerts and trend deviations to flag risks like cost overruns, declining margins, or cash shortfalls

- Visual performance snapshots tailored for leadership visibility and decision-making

- Cross-departmental alignment by integrating sales, HR, and operations data into forecasting logic

Scenario Planning: Your Business’ Early Warning System

At R2 Advisors, we implement what we call "financial radar." This goes beyond budgets. It’s the active practice of asking: What if? What if your top customer leaves? What if interest rates rise? What if employee costs grow faster than revenue?

One of our nonprofit clients modeled three growth strategies. The most aggressive one was appealing—but a scenario model revealed it would turn cash-negative in seven months. They adjusted early and preserved $600K in reserves.

What Businesses Can Learn from the Texas Flood

- Forecasts Must Be Interpretable: Like flood warnings, business insights must be clear and actionable—especially for executives, boards, and non-finance teams.

- Preparedness Beats Perfection: Static budgets or one-time forecasts aren’t enough. Real resilience comes from rolling forecasts and live data updates.

- Scenario Planning Saves Lives—and Companies: From cash flow to customer churn, modeling alternative outcomes allows organizations to pivot early—not react late.

Final Thought: Be Your Organization’s Weather Radar

Forecasting is not a passive tool. It is your company's early warning system. Don’t wait for the financial equivalent of a flash flood to expose where you’re unprepared.

Let the Texas floods be a call to action. Every organization—whether a tech startup or a community nonprofit—needs to forecast like their future depends on it. Because it does.

Is Your Financial Forecast Built to Withstand the Storm?

Discover how our CFO services can help you develop resilient, real-time, and strategic forecasts tailored to your business. Now is the time to elevate your financial visibility.

Contact Us