Hidden Leverage or Hidden Liability? What Private Equity and Family Offices Must Know About Multi-Tiered Entity (MTE) Structures

When a family office acquired a controlling interest in a boutique manufacturing business, everything on the surface looked clean. U.S.-based, profitable, and fully audited. But six months in, the CFO noticed inconsistencies between projected distributions and actual cash flows. What unfolded was a lesson in modern entity structuring: buried beneath the flagship company were five SPVs, an offshore IP holding subsidiary, and multiple intercompany loans that had never been formally documented.

Welcome to the world of Multi-Tiered Entities (MTEs), where the value isn’t just in the assets, but in the structure itself.

What Are MTEs?

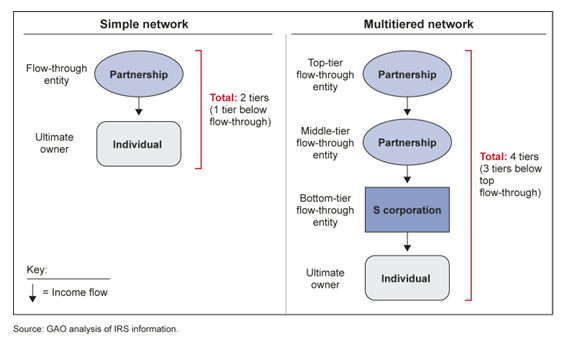

Multi-tiered entities (MTEs) are layered legal structures where a parent company controls multiple levels of subsidiaries, SPVs (special purpose vehicles), and investment vehicles. They are ubiquitous in private equity portfolios, real estate investment platforms, and family office structures. These entities offer flexibility, tax efficiency, and asset protection—but they also introduce significant complexity in valuation, reporting, and compliance.

Why MTEs Pose Unique Risks to Investors

- Layered Ownership: Each tier creates a new layer of financial influence and control to be analyzed.

- Geographic Spread: Subsidiaries across jurisdictions are governed by different laws, tax policies, and disclosure rules.

- Intercompany Transactions: Cash sweeps, management fees, and IP licensing can distort earnings and make it difficult to trace the actual flow of funds.

“With MTEs, it’s not just about value—it’s about structure. A strong framework maps ownership, aligns reporting, and ensures tax compliance at every level.”

— Rose Araghchy, CPA, Founder & CEO, R2 Advisors PC

A Framework for Financial Clarity

- Define the Purpose – Valuation must reflect intent: tax, sale, dispute, or internal planning.

- Map Ownership in Full – Build a transparent, tier-by-tier diagram.

- Select the Right Valuation Method – Income, asset-based, or market approach should align with entity function.

- Assess Ownership Rights – Controlling vs. non-controlling interests impact value.

- Apply Strategic Discounts – Use DLOC and DLOM cautiously to avoid over-discounting across layers.

- Calculate Tier-by-Tier, Then Roll Up – Model value from the bottom up.

- Document Everything – You’ll need it for both internal review and IRS defensibility.

What Influences MTE Value?

- Lack of Control

- Illiquidity

- Voting Rights

- Ringfencing via SPVs

- Cross-Border Risks

- Cumulative Discounting

“In multi-tiered structures, the real risk isn’t complexity—it’s invisibility. Without a framework that surfaces intercompany flows, jurisdictional mismatches, and control dynamics, tax and reporting decisions are built on assumptions, not facts.”

— Rose Araghchy, CPA, Founder & CEO, R2 Advisors PC

The Legal and Regulatory Terrain

Family offices and PE firms must also account for:

- Legal Precedent: Discount stacking and SPV transparency are hot areas for IRS scrutiny.

- Jurisdictional Variance: Reporting rules vary widely between U.S., Cayman, Luxembourg, and beyond.

- Compliance Burden: Transfer pricing, BEPS, and entity-level tax rules increase audit exposure.

Industry Applications

| Industry | Application of MTEs |

|---|---|

| Private Equity | Foundational in fund structuring, SPVs, and co-investments |

| Real Estate | Uses SPVs to ringfence risk; makes consolidated valuation complex |

| Technology & IP | Heavy on intangibles; requires specialized models for cross-border licensing and valuation |

MTE Structure Comparison: Simple vs. Complex Layered Entities

Entity Structuring & Tax

Build Smart. Stay Compliant.

R2 Advisors helps you design, restructure, and manage multi-tiered entities for tax efficiency, compliance confidence, and operational clarity.

Schedule Your Consultation →Section 2: Additional Compliance Considerations for Multi-Tiered Entity (MTE) Structures

Multi-Tiered Entity (MTE) structures, involving partnerships, S corporations, and trusts, are widely used by family offices and multinational companies for tax optimization, liability protection, and investment control. A 2012 IRS SOI study titled Linked Return Filing Entities Using Schedule K-1 Data provides insights into how these structures function and their wide adoption.

Highlights from the IRS Report

- More than 1.5 million partnerships and S corporations filed K-1s, and nearly 50% of these entities were linked to at least one other return via ownership or partnership structures.

- The most common MTE structures involved 2 to 4 tiers, frequently used to manage investments, shield liability, or separate business functions.

- These structures are prevalent in industries such as finance and insurance, real estate, oil and gas, and professional services.

- Source: Larry R. May, IRS Office of Research, Using Link Analysis To Identify Indirect and Multi-Tiered Ownership Structures, Statistics of Income Division, Internal Revenue Service.

Use Case Table: MTE Structures by Industry

| Industry | Example Company/Use Case | Purpose of MTE Structure |

|---|---|---|

| Family Offices | Multi-generational investment vehicles | Liability protection, estate planning |

| Real Estate | REITs, development holdings | Segregate assets, 1031 exchanges |

| Venture Capital | Feeder funds, fund-of-funds | Foreign investor compliance, U.S. tax strategy |

| Healthcare | Physician group + facility structures | Separate operations, limit liability |

| Oil & Gas | Joint operating ventures | Depletion deductions, investment sharing |

| Global Corporations | IP & international subsidiaries | Transfer pricing, cross-border planning |

2025 Developments Impacting MTE Structures

1. Proposed Regulations on PTEP and Partnerships

- Clarify basis tracking under IRC 959/961 using an aggregate partner-level method.

- New rules increase complexity for tiered partnership reporting.

2. Increased Reporting and Audit Scrutiny

- IRS uses AI for auditing large passthrough entities.

- New Schedule K-1, K-2, and K-3 disclosure requirements for international and QBI items.

3. Section 199A Deduction

- 20% QBI deduction remains available through 2025.

- Requires extensive tiered entity disclosures.

4. Trust Structures and Section 643

- IRS guidance (AM 2023-006) warns against trust-based tax deferral schemes using Section 643 misinterpretations.

- All capital gains and income must be reported by non-grantor trusts.

5. Obsolete IRS Guidance

- Rev. Rul. 91-32 and others removed; TCJA codification prevails.

6. Section 174: R&D Amortization

- R&E costs must now be amortized (5 years domestic, 15 foreign).

- Impacts venture-heavy family offices and operating subsidiaries.

7. SALT and State-Level Compliance

- States now require tax basis capital reporting and PTE tax filings.

- Multi-state family offices face higher compliance burdens.

Summary Table: 2025 MTE Tax Developments

| Area | 2025 Change | Impact on MTEs |

|---|---|---|

| PTEP & Partnerships | Proposed basis tracking regulations (REG-105479-18) | Partner-level complexity; capital mismatch risks |

| Audit Scrutiny | AI-driven audit expansion | Higher risk of audit for large, tiered entities |

| Section 199A | Deduction through 2025 | Detailed tiered reporting burdens |

| Trust Taxation | Clarified rules on capital gain treatment | Non-compliant trusts may face penalties |

| Obsolete Guidance | Removal of outdated IRS rulings | Greater reliance on updated regs |

| Section 174 | Required amortization of R&D | Impacts VC-backed entities and subsidiaries |

| SALT | New PTE regimes and reporting obligations | More filings across multiple states |

Conclusion

MTE structures offer strategic value, but the 2025 tax landscape brings significant compliance burdens. Family offices and corporations should reassess their structures and reporting frameworks to ensure audit readiness, accuracy, and alignment with new regulatory trends.

Citations:

IRS SOI Report (2012)

Source: Larry R. May, IRS Office of Research, Using Link Analysis To Identify Indirect and Multi-Tiered Ownership Structures

IRC Sections 959, 961, 199A, 643, 174

IRS Proposed Regs REG-105479-18

IRS AM 2023-006

Notice 2025-22